Will credit cards ‘check out’ with BNPL?

The jury is still out. Meanwhile, BNPL stays on a prowl.

Looking to purchase an appliance or a piece of fine jewelery? Let’s take a moment to walk through two possible scenarios, online or offline. You make your choice, but it’s a little above your budget. You can’t make an upfront payment, so you decide to save some money and come back later.

In the meantime, you find a better deal.

Now consider the alternative. You head to check out, and you’re offered an option where you can pay for your purchase in convenient, low-to-zero interest monthly payments. You purchase the product, the brand doesn’t lose out on business - it’s a win-win.

That’s the beauty of Buy-Now-Pay-Later (BNPL). It’s a consumer-oriented payment method that equally benefits the retailers and platforms offering it. According to a study by Cardify.ai, close to 50% of people are spending more when using a BNPL service than they would spend on a credit card. In India, adoption of BNPL is set to rise at a 24.2% CAGR from 2021 to 2028, taking the gross merchandise value of BNPL in India to $52,827.2 million.

Instant gratification coupled with minimal to zero interest and additional fee is driving BNPL’s popularity among consumers. For merchants, it’s a lot of factors - the opportunity to serve a wider base of customers and increase their sales. It also allows them to upsell easily, encouraging customers to purchase higher - end or premium versions of products which they may not have been able to afford without BNPL.

At this point, some may ask why this particular payment option is especially popular, considering installment based payments and credit cards have been around for a while. The answer, for the large part, lies in human psychology. Consumers want the purchasing process to be as easy as possible. And that’s what makes BNPL stand out - it’s just so simple. There are no credit checks or prequalification hassles, no one time password - it’s over in a matter of a few clicks.

But why should consumers have all the fun? Customer experience is gaining importance even in the B2B space. In fact, it is considered ‘very important’ by 86% of B2B CMOs. Unlike B2C commerce payments, B2B commerce payments are recurring and have significantly larger order volumes. This makes a seamless payment experience especially important for B2B commerce. That’s one of the reasons why it’s becoming an increasingly popular payment method in B2B transactions as well.

The core problem B2B BNPL solves in B2B e-commerce is one that’s also relevant to B2C transactions, i.e. the lack of liquidity at both the retailer and the seller’s end. The advantage in a B2B context is that it reduces the risk for the merchant, who is paid immediately.

For the E-Commerce platforms that offer it, B2B BNPL improves acquisition to activation ratio, boosts customer lifetime value, and distinguishes it from competitors.

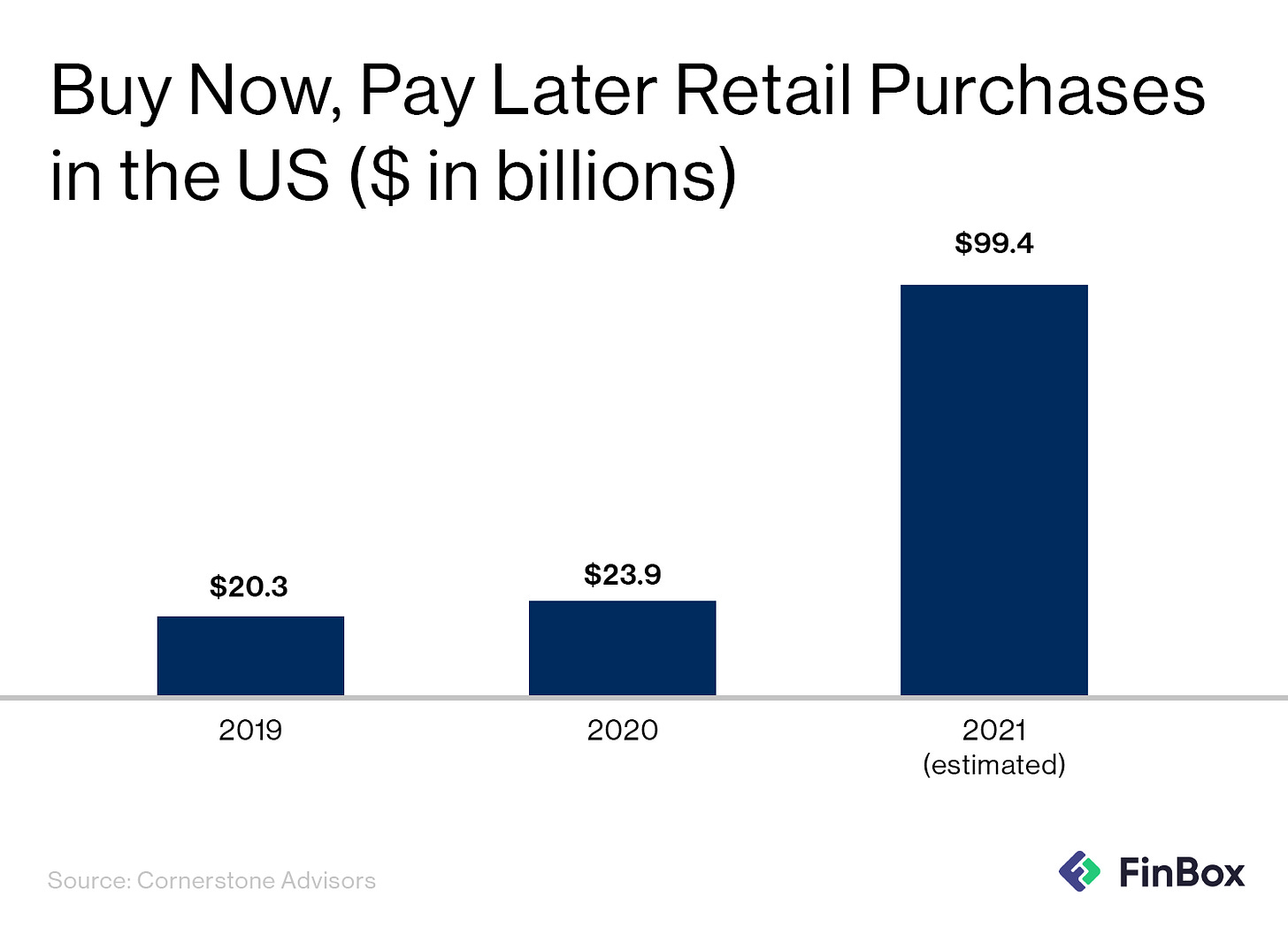

Clearly, BNPL is here to stay. It’s expected to account for 3% of the global ecommerce spend by the year 2023. Will it push credit cards outside the payments race completely? Perhaps not.

According to research in the US, 62% of buy now, pay later users think BNPL could replace their credit cards, though only about a quarter want that to happen.

In addition, a new TransUnion study has shown that BNPL is not taking away market share from other lines of credit. What it is doing though, is opening up opportunities for businesses and consumers, and simplifying the payments process at both ends - and for now, that’s more than enough.