Why Zero MDR isn’t the solution to payment digitization that we think it is

The modern consumer’s expectations around convenience have had an evolutionary jump. And seamless payments seem to have become non-negotiable. Almost half of the payments in India are already happening on digital channels and is expected to triple to $10 trillion by 2026 — that is two out of three transactions will go through payment apps.

How did a digitally illiterate country like India outpace the world in digital payments?

India’s phenomenal growth in adoption of digital payments is riding on the back of UPI, whose penetration was strengthened by the government's zero MDR policy.

What is the zero MDR policy and why it matters?

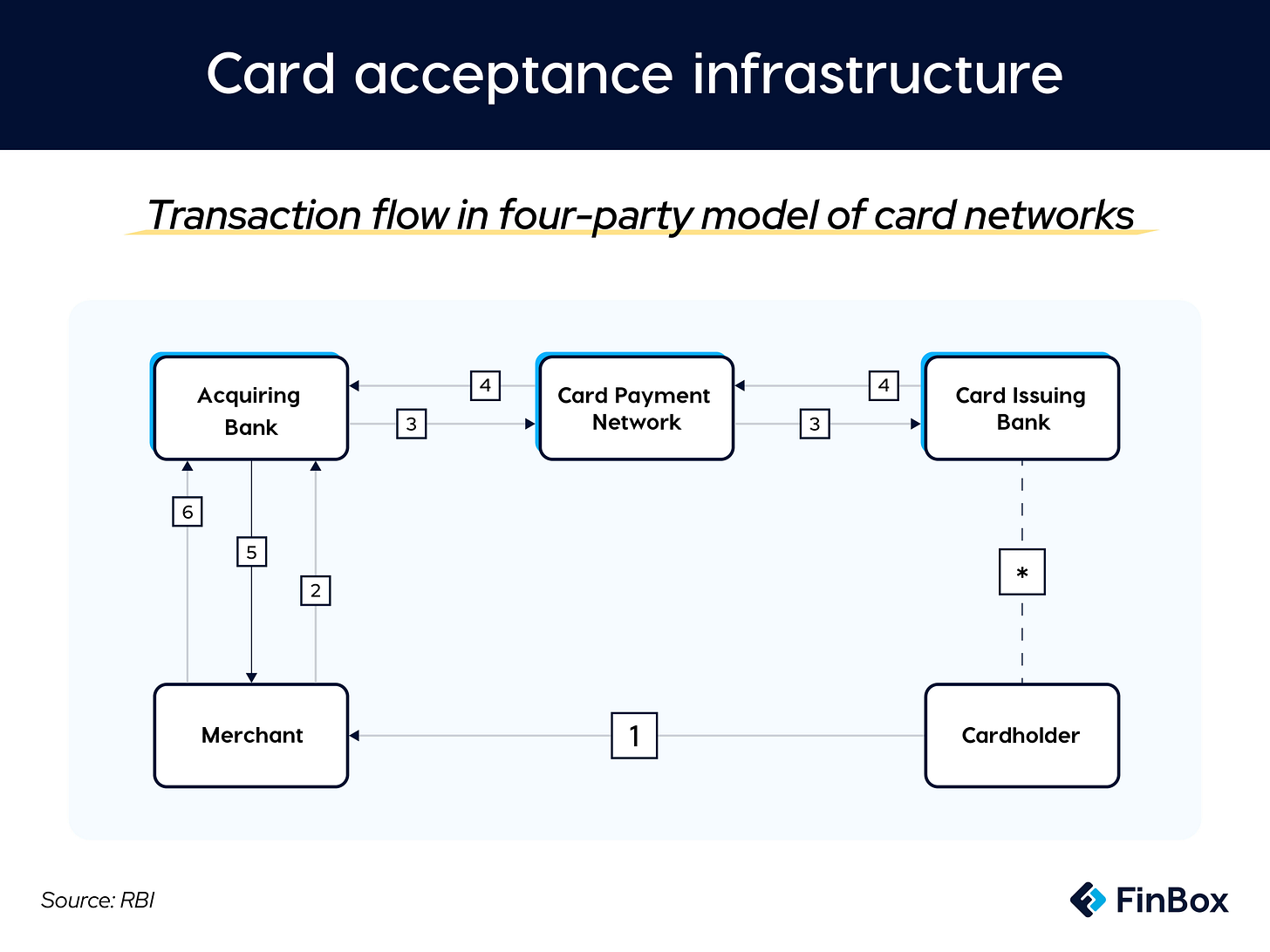

Merchant Discount Rate (MDR) is the fee that acquiring banks — the ones that acquire a merchant and install point of sale machines — charge the merchant per transaction. This fee is then distributed among the different participating entities such as issuing banks, card network companies, and Payment Service Providers (PSPs).

In a bid to promote digital payments, the government abolished MDR on transactions through homegrown RuPay and UPI platforms starting January 1, 2020.

Essentially, neither consumers nor merchants have to pay for the payments infrastructure and service. But somebody ought to pay. Because multiple entities have invested millions of dollars in building and maintaining the infrastructure, acquiring users and getting them habituated to the digital payments ecosystem.

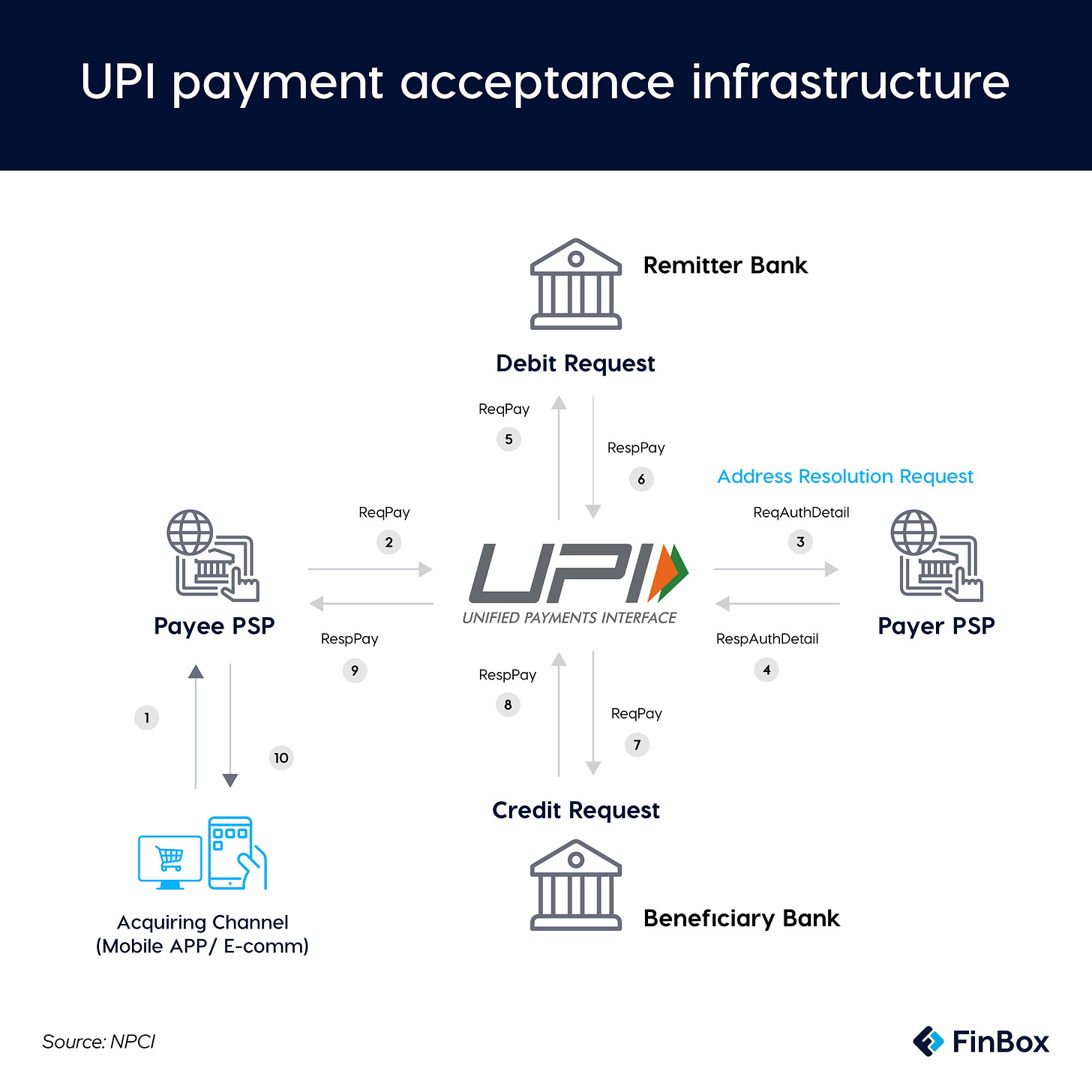

In order to better appreciate the economics of these payment methods, it would be useful to have a perspective on the entities involved and the generic workflow in the two types of transactions — card and UPI.

Here’s what happens behind the scenes when you swipe your debit card (Refer the illustration above)

The consumer swipes the card on the merchant’s PoS machine

The merchant (terminal) sends the encrypted transaction data to the acquiring bank system

The acquiring bank sends the transaction data to the consumer’s (card issuing) bank over the card payment network.

The issuing bank authenticates the cardholder details and based on successful authentication issues an authorization code or declines the transaction.

The acquiring bank notifies the merchant that the transaction either has been authorised or declined; the merchant then completes the transaction and prints the receipt for you.

Subsequently, the merchant, through the acquiring bank, will claim the settlement for funds. The inter-bank settlement (between issuing bank and acquiring bank) will take place through the card network.

Here’s what happens behind the scenes when you make a payment for an e-commerce transaction via UPI (Refer the illustration above)

Account information of the payee (merchant) and the payer (consumer), along with transaction details are securely sent from the consumer’s payment app to the payee Payment Service Provider’s (PSP) server.

They are then forwarded to the UPI interface (at NPCI).

NPCI forwards this to the Payer PSP and requests for authorisation, based on which a debit request is sent to the payer’s bank account, followed by a credit request to the beneficiary’s bank account.

Once all the above requests are authorised, the payee PSP is notified either that the transaction has been authorised or declined.

Subsequently, the consumer is notified of the same

The magnitude of the exercise that runs in the background is obvious from the above two illustrations. It is therefore only fair that all participating entities have enough incentive to keep at it. However, with zero MDR, the incentives have reduced for payment service providers to invest in and maintain financial infrastructure they have built to enable digital payments. In fact, it has been a loss-making exercise for all entities involved. Estimates suggest that the policy cost the payment industry ₹1,800 crore in 2020 alone.

The payments industry has paid a high price to prop up Cashless India

In a communication to the Finance Ministry, the Payments Council of India — which is the largest industry body for digital payment aggregators — said it expects a loss of ₹5,500 crore from UPI and RuPay debit card payments as the MDR is zero.

Last year, the Union Cabinet approved an incentive scheme worth ₹1,300 crore for 2022-23 to promote RuPay debit cards and low-value UPI transactions up to Rs 2,000 by reimbursing MDR to banks. But is it enough incentive to sustain India’s payment revolution?

Banks have already started giving RuPay step-motherly treatment while issuing debit cards. Issuance of RuPay cards have been trending down, as banks prefer to issue Visa and Mastercard debit cards that fetch 0.4-0.9% MDR.

UPI’s case is no different; it has been causing agony for banks. With rising low-value transactions, operation costs have gone up as settlement and reconciliation activities have increased.

The regulator’s latest move allowing linking of RuPay credit cards to UPI has raised concerns around pricing. On credit cards, MDR currently ranges between 2-3% of the transaction value. Once linked to UPI, if the MDR remains zero, it would accrue even higher losses as there’s cost of funds additionally involved in issuing credit cards. Hence, bringing about a pricing structure is inevitable. NPCI and banks have suggested levying an MDR of 2% for UPI-linked credit card transactions.

Typically, credit card MDR is determined by market forces. However in this case the NPCI has prescribed the rate — some argue that this is a clear case of overreach. Yet it’s a welcome move as 2% is better than zero. But in all likelihood, these rates will further rationalise in the short- and medium-term. Here’s why. In India, there are roughly 50 million merchants accepting UPI payments compared to mere 6 million card PoS machines. Thus this move is likely to boost credit card spends.

According to Goldman Sachs, every 5% incremental credit card transaction volume due to UPI integration will equate to $38 billion in additional annual credit card volumes, or $760 million in additional MDR pool (if MDR is in line with the current credit card MDR).

In all probability, MDR will soon be whipped into shape! But the tricky part is figuring out a rate that incentivises enabling entities and at the same time does not disincentivise users. Last week, I had raised the same dilemma with respect to Account Aggregator. The thing is, it's dicey — what's an incentive for one may be a disincentive for another. How do we arrive at an equilibrium? I'd love to know your thoughts on the same.