Why are banks suddenly opening new branches in the digital era?

Will brick-and-mortar crush digital?

Two years ago, everybody was talking about the imminent death of bank branches. In fact, I had myself made some back-of-the-envelope calculations to see if there’s any merit in the claim of disappearing bank branches. And it was clear from data; the downward trend in branch opening between 2013 and 2021 was unmissable.

What changed in the last two years that turned this eight-year-old trend right on its head?

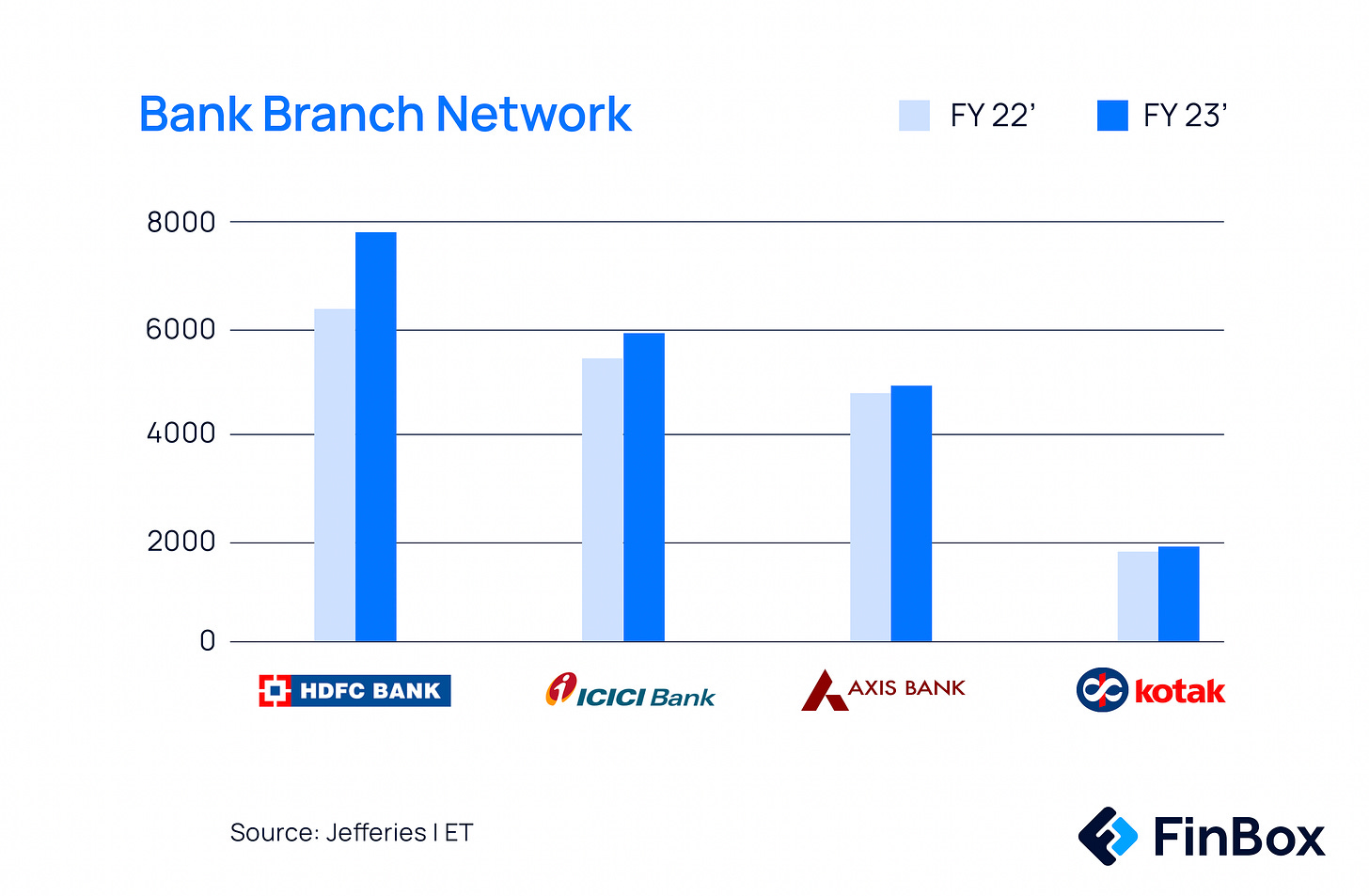

Banks have pivoted to branch-led growth, that too rather aggressively. Let me lay out some numbers for you, so you can better visualise just how much banks are banking on branches for growth. Private banks, in particular, have been on a branch expansion spree. Between 2021 and 2023, HDFC Bank added a whopping 2,487 branches, while other top private banks such as ICICI, Axis, and Kotak added 538, 317, and 174 new branches respectively.

What explains the addition of more than 3,500 branches in the past two years by just the top four private banks in the country?

The consensus seems to be that a physical branch is crucial to mobilise deposits – something that is hard to come by through apps. The thinking is that to build a new customer base for deposits, banks must be visible in areas where they want to draw customers.

Clearly HDFC, which recently merged its home-financier parent with itself, seems to be leading the pack. Now, just to play the devil’s advocate, could it be that it’s a temporary move spawned by the merger to help correct the assets-liability mismatch? And has this in turn, set off a round of competition among lenders to be 'seen' on the ground?

Well numbers say otherwise, although they don’t always paint the full picture. From the first quarter of FY22 to the second quarter of FY23, business per branch has grown by 5.9 percent for HDFC Bank, 9.44 percent for ICICI Bank, 11.59 percent for Axis Bank, and 11.53 percent for Kotak Mahindra Bank.

Do you really need feet on the street to rope in CASA accounts?

Well, the ‘branch out plan’ seems to be working so well for HDFC Bank that they have decided to continue expanding its branch network at the same speed in the current financial year.

HDFC bank garnered Rs 1.5 trillion in deposits during the January-March quarter of FY23. It exceeded its target Rs 1 trillion in deposits in a quarter for the first time since it announced its merger with HDFC last April – that too when its deposit rates aren't the highest in the industry.

One of the positive trends over the past year has been the 300-bps improvement in deposit growth to 13% YoY, the highest in 6 years. The jury is still out on whether it is entirely attributable to branch expansion. For instance, there are outliers; Kotak is the only bank to witness a decline in CASA per branch over the last few quarters of FY22-23 and a majority of its new accounts were opened via digital means. But banks, by and large, seem to be convinced that physical presence is integral to establishing a complete relationship with the customer.

Why ‘brick-and-mortar’ makes sense for a country such as India?

India’s digital journey has truly been remarkable; digital transactions jumped from 2,071 crore in FY18 to 9,192 crore (till December) in FY23. Having said that, cash in circulation also increased to ₹30.88 lakh crore, about 72% higher compared with November 2016, the time of demonetisation.

While digital channels have eased everyday banking, it hasn’t and couldn’t have made cash obsolete. And as long as cash in circulation maintains an upward trend, there ought to be branches that retailers and SMEs can have a relationship with to deposit cash at the close of a business day.

Another major factor is that India is a big market for gold and jewellery, making facilities such as lockers important. Additionally, branches play a crucial role in serving diverse customer demographics, especially those less comfortable with digital banking, such as the elderly, and individuals who prefer face-to-face interactions for financial transactions or loans involving large sums.

It is without doubt that branches serve functions that are not easily substitutable. Having said that, digital channels also have a niche that branches cannot adequately cater to. Digital channels have unequivocally demonstrated their effectiveness in catering to mass products – whether it’s short-tenor loans or small- ticket mutual funds. It is unlikely that a branch-based model will match the economies of scale achievable via digital channels when it comes to small-value products.

The bottom line

It’s always been clear that ‘phygital’ is the way to go, as things stand. The way banks leverage physical and digital channels will guide their market share. However, I cannot help but wonder if there’s more to this sudden shift in strategy to branch-led expansion.

One thing’s for sure, in a physical branch-led model, costs are fixed unlike in the case of digital customer acquisition. For instance, it’s public knowledge that it takes about 22 months for a new HDFC branch to break even. On the other hand, to effectively acquire customers digitally, you need to employ various strategies, up your partnership play, and above all be tech savvy. Achieving cost consolidation in digital-led growth will take time, for bankers to have a thorough understanding and familiarity with the marginal costs associated with their digital business operations.

However, digital is the inescapable reality and future of delivering financial services and thus, lenders would do well to optimise the sourcing and cost of physical while building the future with digital.

Ramblings aside, it would be interesting to see how unit economics of a branch would compare to unit economics of a neobank (a wholly digital bank), something I aim to take a go at, sooner than later.

Until then, stay informed, stay curious!