What's the fuss about Account Aggregator anyway?

There was a lot to take away from the Economic Survey 2023-24, but one of the details that stood out to me was the fact that 1.1 billion bank accounts are now eligible for data-sharing on the Account Aggregator framework!

As one of the early adopters of this framework, this was exciting news for us at FinBox. In fact, the Survey pointed out several other milestones that the ecosystem has crossed so far –

23 banks are now live with the Account Aggregator functionality

4.2 million users have linked their accounts with the framework

4.4 million users have so far successfully shared data via the ecosystem

31 financial institutions have gone live as Financial Information Providers (FIPs)

Overall, 142 financial institutions have now gone live as Financial Information Users (FIUs)

The Account Aggregator ecosystem has been constantly likened to India’s UPI moment - it was poised to usher in the same ease and convenience in sharing of financial information that defines payments through UPI.

And the numbers speak for themselves.

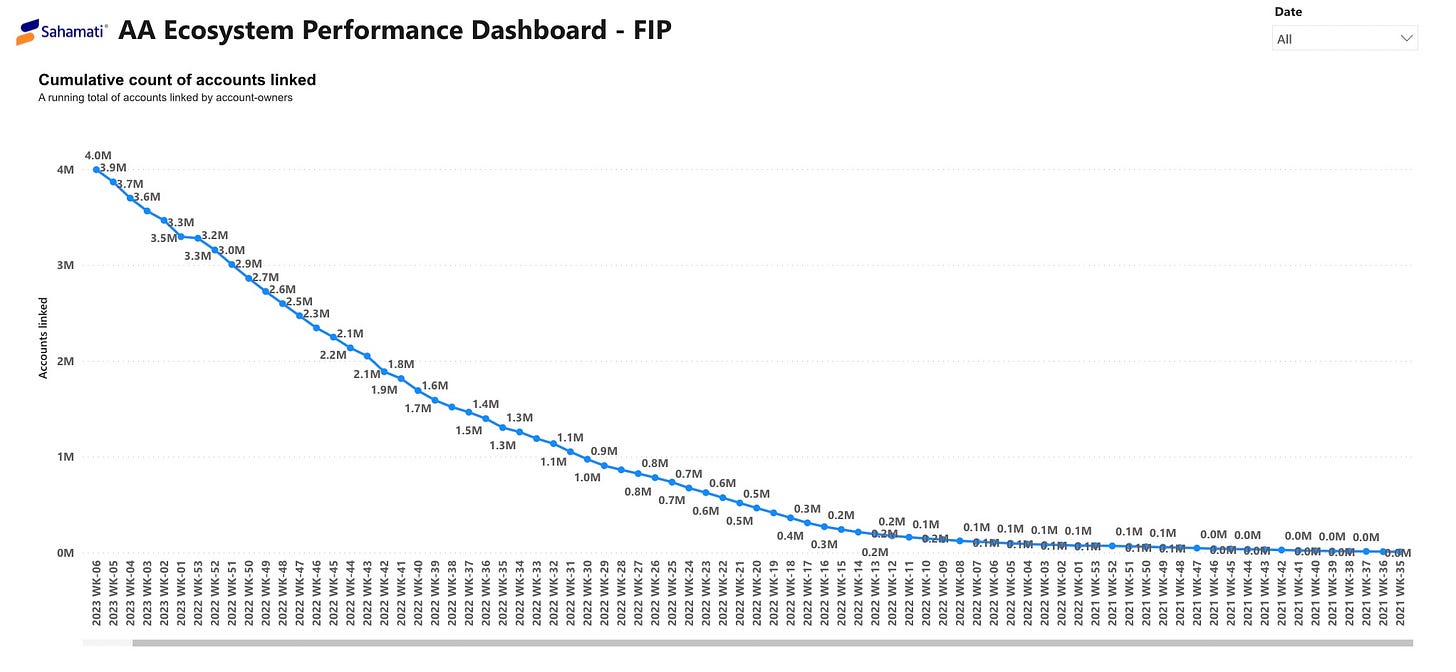

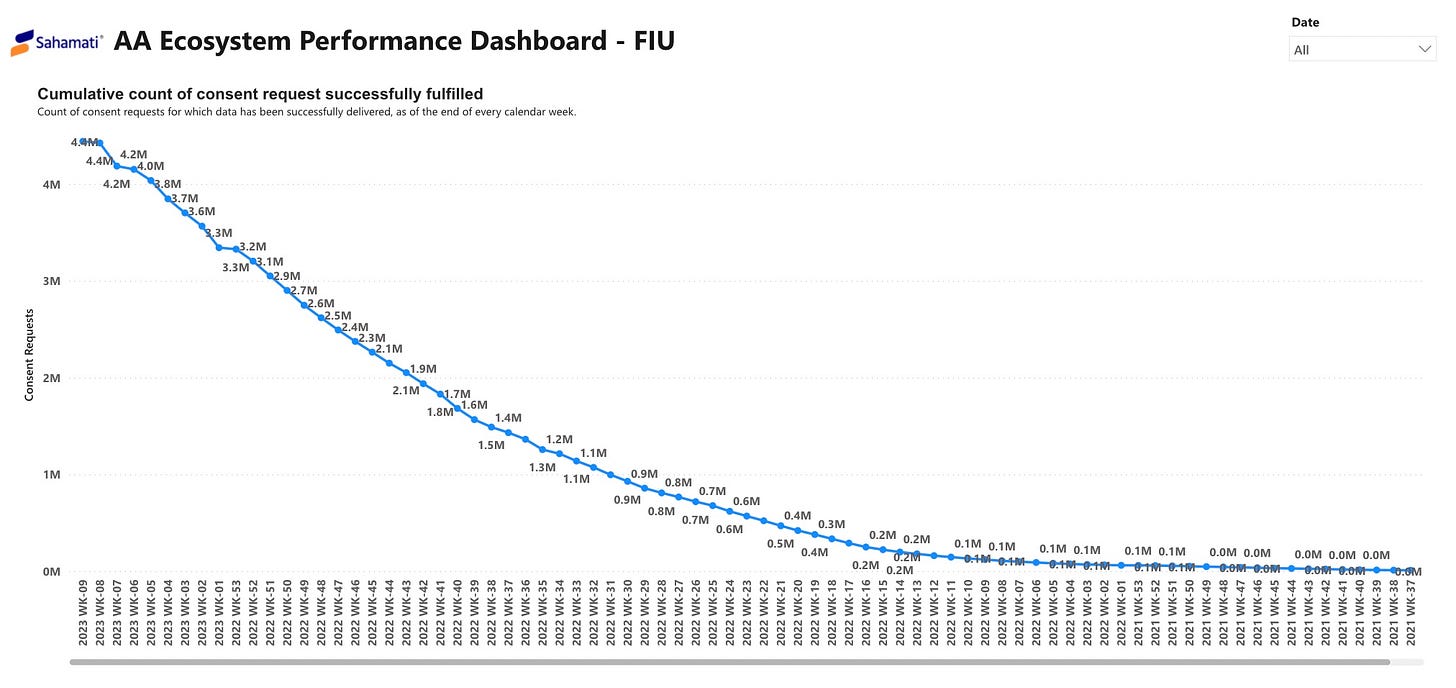

A good measure of the ecosystem’s market size is the growth in the number of accounts (FIP-side metric) and the number of consent requests successfully fulfilled (FIU-side metric).

In April 2022, the total number of accounts registered on the framework was only 0.2 million. New accounts on the framework in February 2023 stood at 4.2 million. These numbers indicate a meteoric rise in AA adoption on the FIU side.

Similarly, the growth in Financial Information Users can be gauged by the rise in the number of consent requests fulfilled. In April 2022, the number of consent requests fulfilled hovered around 0.2 million. This number in February 2023 is ~4.4 million. This number is expected to rise to 1 billion by the end of 2025 and 5 billion by 2027, Sahamati, its self-governing body, estimates.

Evidently, the Account Aggregator ecosystem has established itself as a dynamo growing at stunning speed. But what were the blind spots it was created to cover? Let’s look at the gaps the Account Aggregator framework fills.

We compiled a case study on how Account Aggregators help reduce frauds and improve conversions. Read it here.

Just last month, I had the privilege of hosting an enlightening webinar on the AA revolution in digital lending and its future. You can watch it here -

Enabling open banking in India

Open banking in India has been facilitated largely by its digital public infrastructure, with the India Stack at the center of it. While the flow of people and money under this infrastructural framework was addressed by the identity layer (Aadhaar) and the payments layer (UPI), the exchange of information is addressed by its secure, DEPA-compliant Account Aggregator ecosystem.

Solving for mistrust: Apart from simply aggregating and facilitating an exchange of financial information, Account Aggregators in India are solving trust and data security concerns. They act as channels through which the data is passed. They cannot access or store the data that is handled by them.

Regulator-driven data aggregation: Unlike information sharing for open banking in the US, the Account Aggregator framework in India is not an industry-driven mechanism, but regulated by a state authority.

Encouraging competition: Onboarding on the Account Aggregator network is not enforced by the regulator, only prescribed (with the state setting an example by onboarding all PSUs to the network). In doing so, India will hold up the spirit of open banking - to encourage competition.

Contrast this with open banking in the UK where the system is mandatory and crushes competitiveness for small banks as the market is dominated by large ones.

Complementing bureau data: The Account Aggregator ecosystem introduced a consolidation of financial information beyond just credit behaviour insights that could be drawn from credit bureaus. It is a non-profit that facilitates the aggregation of banking, spending, insurance, investment and other financial information.

The ecosystem, despite its astronomical growth, is still a work-in-progress

While the framework covers retail lending fairly comprehensively, it still has a long way to go when it comes to MSME lending. According to Sahamati, retail lending will comprise 38% of the bank statements shared through AAs by 2027. In the same year, only 10% of the bank statements shared through the framework will be used for MSME lending purposes.

The RBI’s recent notification of the Goods and Services Tax Network (GSTN) as an FIP on the ecosystem will allow for credit to the MSME sector by way of invoice financing and more. In fact, the Finance Ministry’s proposed National Financial Information Registry (NFIR) could potentially plug this gap as it will make credit and non-credit information available from the Ministry of Corporate Affairs (MCA), tax departments like the CBIC and the CBDT and even the CERSAI.

Data security - the most revealing piece of the puzzle

Evidence of the eager uptake of the Account Aggregator framework must not overshadow the fact that concerns still persist around a crucial piece of the data aggregation puzzle – security and privacy.

But, the RBI’s directives around data security and the upcoming data protection legislation can be counted on to address these concerns. The framework has been created on the basis of the Data Empowerment Protection Architecture, enabling users to create access and share data on their own terms.