The pursuit of scale is seldom an exercise in even-handedness. We see this happen with business all the time – numbers around usage may rise and rise in quantity, but quality is determined by a number of sister variables that may not behave similarly. And while the former is a reason to celebrate, it is no more than a vanity metric if the quality of the product remains unqualified by essential determinants of customer satisfaction and user experience.

I worry that it might be the path that Unified Payments Interface (UPI) is on in India. Every month, quantitative figures like transaction values and volumes are reported widely (March 2023 saw a record 8.7 billion transactions through the payment rail). But even as we celebrate the crowning glory of India’s digitisation saga, a concerning blight is slowly growing in the ecosystem.

I crunched some numbers reported by the National Payments Corporation of India (NPCI) over the last year to figure out if there are skeletons in the closet. Here’s what I found.

Transaction failures aren’t being addressed sufficiently.

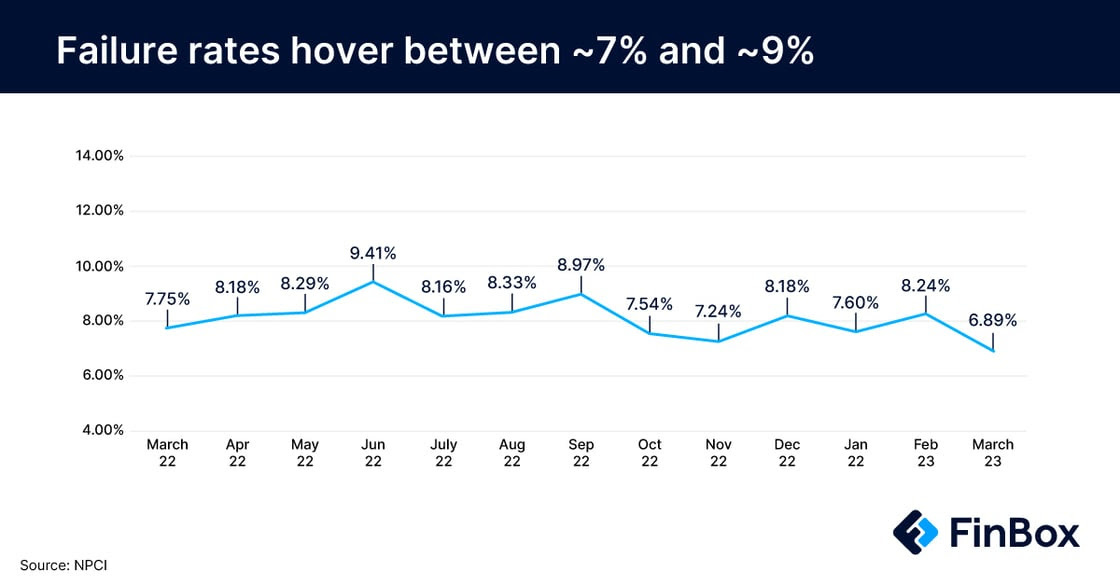

Since March 2022, the number of monthly transactions carried out by remitter banks has almost doubled from 5749.46 million to 9074.86 million in March 2023. Meanwhile, the corresponding number of failed transactions has remained somewhat consistent from 445.85 million in March 2022 to 625.23 million in March 2023.

(Data only from top 50 remitting banks)

The percentage of failed transactions hovered between ~7% and ~9% of the monthly transactions over the last year. The transaction volumes, meanwhile, rose by 34% in the last year.

As the total volume climbs, this number becomes more and more significant as it impacts a larger number of users, bringing down the quality of experience UPI has prized for so long.

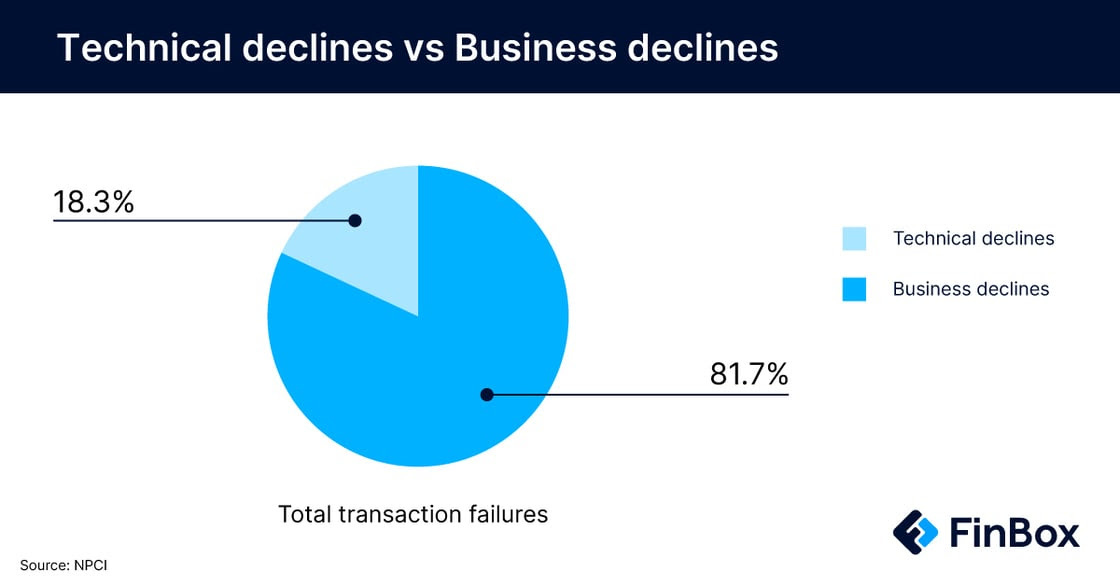

To be fair, over the last year, 81.7% of the total failed transactions were attributed to ‘business decline’ which includes –

Invalid PIN

Incorrect beneficiary account

Exceeding the transaction limit

Exceeding permitted count of transactions per day

Exceeding amount limit for the day

The remaining 18.26% failed transactions occurred due ‘technical decline’. These technical reasons include –

Unavailability of systems

Network issues on bank side

Network issues on NPCI side

Why do declines occur?

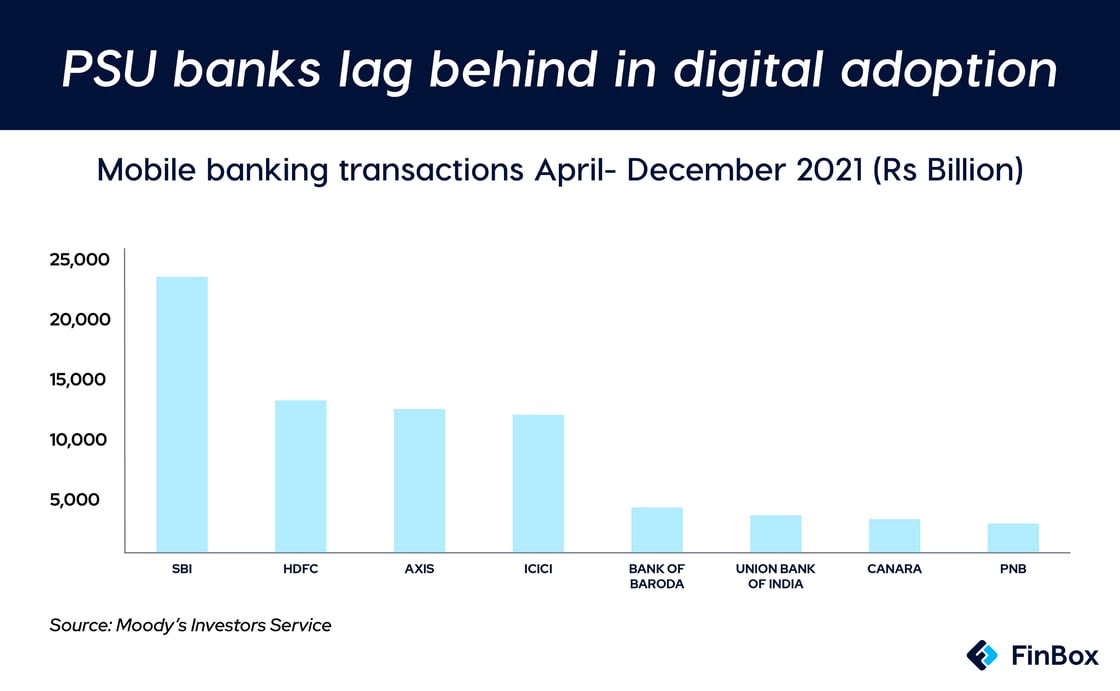

Business declines are a side-effect of poor or limited digital dexterity, and shortcomings in the user experience of these apps. Clearly, banks lag behind when it comes to offering a good user experience compared to UPI-only payments apps designed by non-bank players.

Technical declines caused by system failures, however, are a cause for concern. NPCI data showed that the certain banks, mostly public ones, experienced higher rates of transaction failures. For example, the State Bank of India saw 2.45% and the IDBI Bank saw 7.16% transactions fail due to technical reasons this March. For the India Post Payments Bank, this number stood at 4.26%. That’s because it is no secret that public sector banks have been slow to digitise.

In addition to inadequate digital capabilities, the fact that transaction volumes continue to rise at astronomical rates each month has pressured core banking solutions such that they seem to buckle under.

RBI Deputy Governor Rabi Shankar recently said at the 18th Technology Conference of the Indian Banks’ Association –

“How is it that a system of transactions between two bank accounts has evolved in a way where most of the business is owned by non-banks? Clearly, banks missed a step here.”

The incentive to upgrade these systems in order to keep up with high UPI volumes is negligible because these transactions tend to be low-value, which means banks aren’t making any money from them. This also explains why banks have ceded the market for UPI app-based payments to non-bank, big-tech players – it makes little sense for them to invest in payments-only UPI apps.

This is aggravated by the fact that the merchant discount rate (MDR) was waived off for UPI transactions, closing a potential source of revenue for banks. Right before MDR charges were waived off in January 2020, banks earned an average of ~Rs 33 crore each month from MDR on UPI.

How is this being tackled?

Here’s how it is - banks are reluctant, or at least not incentivised enough, to tackle the problem. It is the NPCI that has designed a solution that may allow customers to dodge pesky transaction failures through UPI Lite.

This version of the payment rail can operate offline, making it useful in regions where lack of internet connectivity deters payments. It debits the sender’s account in the offline mode, and credits the receiver’s account when online – drawing criticism that it essentially works as a digital wallet. Moreover, the user is not required to enter their PIN.

This is indeed an ingenious solution (among many others, like UPI 123Pay) to tackle several reasons for failures such as entering the wrong PIN or snags that may occur as a result of patchy internet connectivity. However, it fails to solve for the technical burden imposed on banks’ systems. At the same time, a no-frills, no-internet version of UPI isn’t going to be mass adopted by anyone who sees a transaction fail - it’s more likely that people will switch to other payment mediums than keep trying to make UPI work through any and all of its avatars.

Scale vs Reliability

Scaling for quantity and quality are two equal vectors – their magnitude and direction must be identical (or at least proportionate). There’s an abundance of apps overlaying the UPI infrastructure (frontend) that have made it possible to achieve unprecedented scale in terms of the quantity of transactions. The quality, on the other hand, seems to lag behind, impacting the underlying system (banks’ backends).

System overhaul for banks will continue to be placed on the backburner as long as banks are caught in a cycle of peddling new and shiny products for a quick turnover. But lack of incentive can’t make them shelve these plans forever. Many institutions seem to be on the path to transformation. However, only prolonged and dedicated focus on it can help banks turn from one-trick ponies to long race horses in the digitisation contest.

Single digit transaction failures (as % of total transactions) on a billion transaction scale isn’t a doomsday scenario but it’s a bellwether of the overall readiness, preparedness, and quality of the infrastructure behind the most simple and complex financial services and products.

It’s high time we build quality products that get scale through distribution but don’t crumble when the distribution strategy works.

What do you think?