Regulation vs innovation: why did RBI close a billion-dollar loophole?

It seems like we’ve only been discussing credit cards over the past few weeks. I’m afraid this pattern shall continue for the next couple of weeks too. This week, there’s been upheaval in the neo-FinTech space as the RBI pulled the rug from under the feet of many promising unicorns and soonicorns that took on legacy banks’ credit card dominance.

A simple two-paragraph announcement on Monday closed shut a loophole that gave birth to billion dollar companies and resulted in more than a million credit cards being issued every month!

Let us first break down what’s happened.

Many FinTechs, in trademark startup fashion, discovered a workaround to distribute one of the most tightly regulated products in the financial domain - credit cards. The idea was elegant, if not a regulatory grey zone.

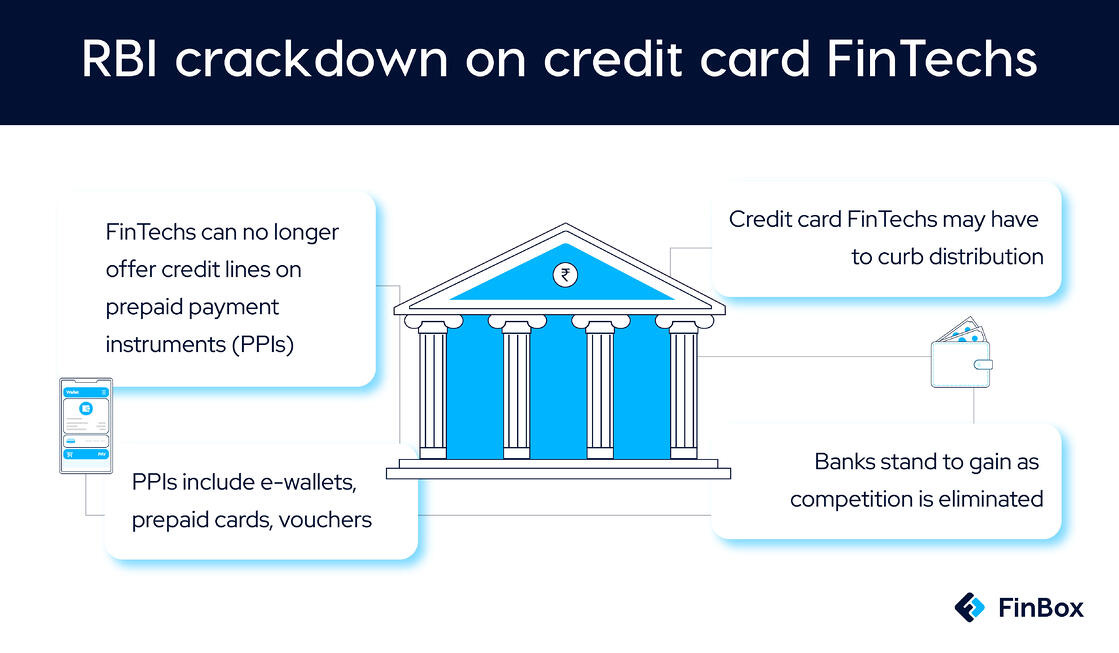

Prepaid instruments (PPIs) are wallets, cards, online accounts, vouchers or anything else that carries a certain prepaid sum and can be used to make a payment. As per RBI’s Master Directions on PPIs, these instruments can be loaded through cash, bank accounts, credit cards and debit cards or any other payment instruments that are issued by regulated entities.

PPIs, if one remembers, is the same licence that gave birth to mobile wallets. The likes of Paytm, MobiKwik etc made lives easier for us by allowing easy transfer of money before UPI was around. Since UPI came in, those wallet businesses have been as good as dead, but the licence found a new lease of life.

New age FinTechs were loading prepaid cards with a credit line - a prefunded account through an NBFC or a bank – and packaging these as ‘credit cards’. To the end user, using such a card was no different than using a credit card. They could divide up their payments into bite-sized instalments and pay them off later.

The model has seen resounding success. Slice alone boasts a user base of 5 million. Peachy.

Now, however, the RBI has clarified that PPIs will no longer be allowed to operate on a credit line. This has left a large portion of the FinTech fraternity fumbling for life jackets.

Unjustified regulatory clampdown?

Naturally, many with business interests in the space feel dejected and disserviced. Anonymously - founders, shakers and movers have accused the regulators of not making up their minds about financial inclusion, of not citing the motivation behind such a change of heart, and of stifling innovation.

Even on more practical matters, industry players are left untethered. They are yet to receive instructions on the treatment of customers already using their products and what can be done to continue onboarding new ones.

The truth is, if some reports are to be believed, the RBI is of the opinion that FinTechs by themselves aren’t sufficiently equipped for proper credit underwriting, nor do they have the capital that traditional banks do - and hence, risky for the financial system and mostly, the end customers.

Given the recent incidents of companies playing fast and loose with the regulatory guidelines, the regulator wants to curb practices that have the potential to hurt the very vulnerable sections they claim to serve. Moreover, offering credit through PPIs – instruments that quintessentially were created to allow people to spend only the money they have – is a misuse of the license thereby negating the intent and spirit of the instrument.

The great untangling

I believe that right now, we’re too close to the puzzle to see the full picture. The move in question appears to be a huge threat for the sector now but will seem like just a blip on the radar in the long run. And here’s why.

Firstly, it is a gross and unfair misconception that regulators are opposed to innovation. There is tons of evidence to the contrary.

The NCPI’s crown jewel, United Payments Interface (UPI) rails has brought about a seismic shift in favor of digitalization. The Bharat Bill Payment System (BBPS), the Account Aggregator framework, the Open Credit Enablement Network (OCEN), and the Open Network for Digital Commerce (ONDC) are a few other examples. The RBI has also routinely held regulatory sandboxes allowing FinTechs to test out their technology with the objective of mitigating fraud.

(Full disclosure: FinBox was selected as part of the RBI’s MSME financing sandbox just recently)

The list goes on. All of us in FinTech have benefitted from these government-backed innovations.

Secondly, regulation isn’t the enemy of innovation. It’s usually a guardrail that allows you to work at the edge of the box instead of going completely outside it and doing stuff that’s potentially much more damaging than the rewards such ‘innovation’ promises.

Spaces like financial services need regulation as much as they need inventiveness. In fact, FinTech is a good example of why.

FinTechs operate in regulatory grey areas while their competitors and associates like banks and NBFCs are highly regulated by a jumble of banking licenses. Without a codified set of directives, they will continue to attract regulation one notification at a time. As a result, enterprising founders can never find sure footing until the role of FinTech is defined.

To conclude...

Here’s how I see it - the RBI is showing an interest in defining the contours of an early licence prototype made for FinTechs. After all, it is due to release its digital lending vision (accompanied with certain norms) by July.

Sure, the process is exhibiting some teething pains, but these issues will be resolved with time.

The urgent concern at this juncture should be that the regulatory framework isn’t piecemeal but absolute. This will allow those affected to quickly pivot and at the same time, figure out what to do with their existing customers. Meanwhile, a certain amount of overcommunication from the regulator will also ensure that loopholes are shut before they start being exploited.

Innovation, after all, is different from shrewdness.

Regulations from here should be aimed at putting future worries to rest so that entrepreneurs can focus on growth.

We need a regulatory framework that involves all stakeholders and allows FinTechs to work with other financial ecosystem players without overstepping boundaries or jeopardising the customer.

A decade’s worth of growth for the financial sector can be all but given if the current regulatory interest leads to an enabling policy framework. This is an opportunity that shouldn’t be allowed to pass us by.

That’s all from me.

I will see you next week.

Cheers,

Rajat

CEO and co-founder

FinBox

PS: I’m happy to announce that this week, FinBox secured its Series A funding of $15 million. We’ve set targets of expanding our workforce and our geographical reach with the singular goal of transforming financial services!

Check out the press release here.