From breaking bad to breaking even: The Indian digital lending saga

What's keeping the disruptors in digital lending from turning green?

Ask seasoned bankers for the money-making secret sauce, and they’ll leave you with

3-6-3. This is code for raising deposits at 3%, lending at 6% and playing golf after 3 PM. Not too bad, right?

That’s the lending game and this is how it has been traditionally played.

But in came digital lenders, and declared the new rule to be 3-1-0, i.e., three minutes to decide, one minute to disburse with zero human touch. They disrupted the lending industry, disintermediated the traditional lenders and, on the hindsight, perhaps set in a dysfunctional business model that harped too much on being data-savvy and not nearly enough on understanding lending as a business.

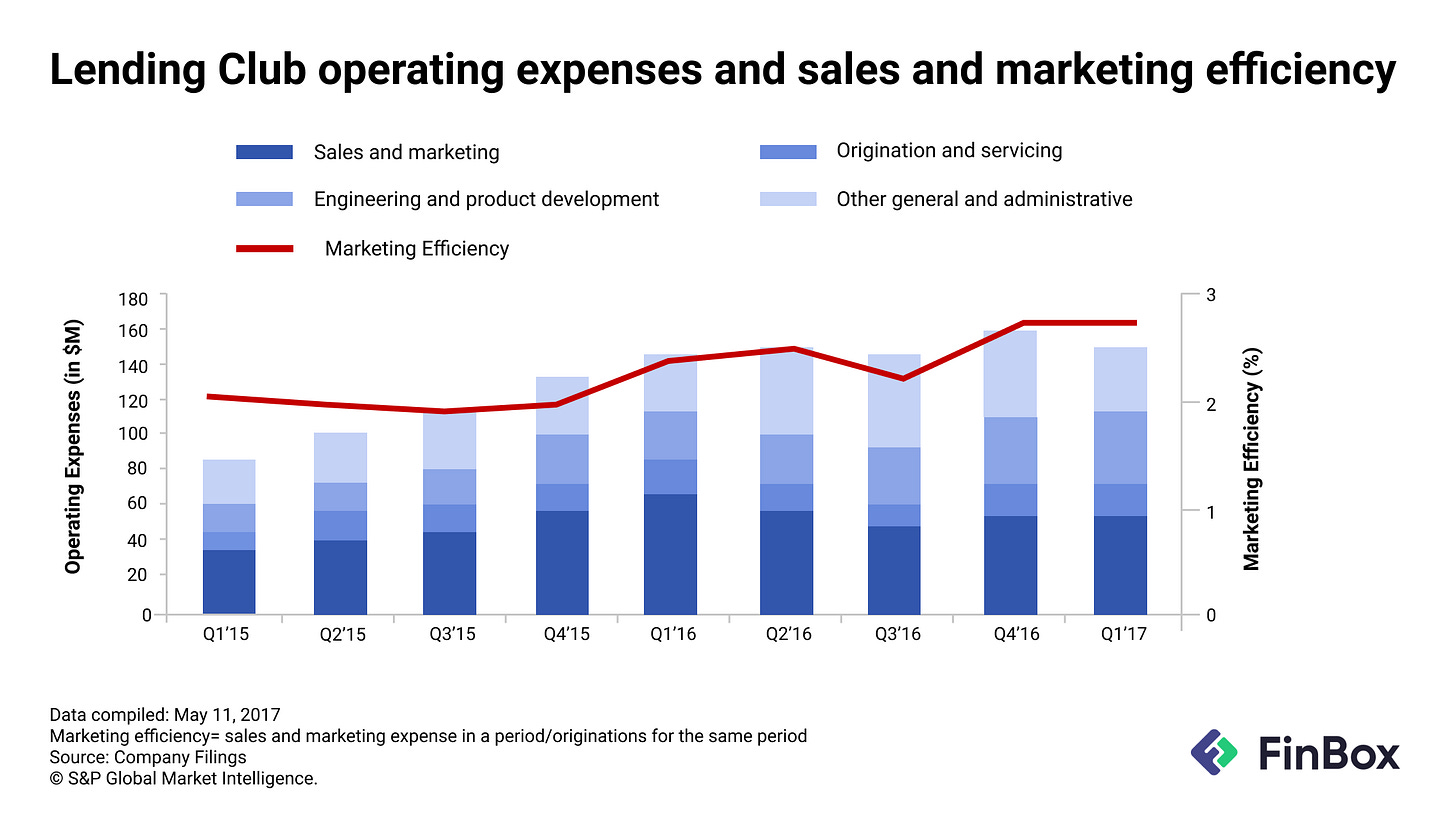

For starters, digital lenders didn’t have any real customer base, unlike the banks. They had to aggressively chase new acquisition channels, shooting overheads in terms of marketing and sales that went way past the loan origination rates (for example, see figure for LendingClub in the U.S.). And this has been a losing game, even for established banks, which typically spend $200 in acquisition costs for new customers that would generate $150 in revenue each year. That puts the breakeven point for most banks at two years in business.

Essentially inverting the 3-6-3 rule, these avant gardes burnt more money trying to stay in the business (and golf isn’t even a thing with them).

Take for example CRED, a deeply-funded two-year old startup that sits on swathes of data on 5.9 million top-tier creditworthy Indians. Stellar, right? You’d second guess that when you look at its financials for the year 2020, where it effectively spent Rs. 727 to earn a single rupee. It fired all cylinders on customer acquisition and a marketing blitzkrieg that speaks for itself, but so do the numbers.

Customer acquisition aside, the new digital disruptors (with at max 10 years in operations) do not have the years of expertise that goes into adequately honed underwriting models. These naive underwriting capabilities, clubbed with the pressure to expand loan portfolios, leads to adverse decisions and a domino effect that helps no one.

Read: New-age lending calls for new underwriting approaches

Lastly, because they cannot accurately underwrite potential borrowers, they end up onboarding unviable risks. They then resort to coercive collection measures that put them in an unsavoury position vis-a-vis the borrower, the capital provider and the RBI.

Read: Five bitter pills from RBI to make digital lending healthier

In a recently released working group report, the RBI basically decimated the digital lending model – effectively doing away with the first loan default guarantee and clipping the technology-led elbow room nefarious digital lenders enjoyed up until now. The report called it technology neutrality. Which is to say, something that isn’t legal offline, cannot be legal online. Stuff like lenders tapping into a borrower’s smartphone to access contacts or images to harass them into repaying EMIs.

Read: The evolution of digital lending

The lesson: Sustainable digital lending is not a technology marvel.

And so, profitability evades digital lenders – in India and abroad – since it is often confused with scalability. PayTM, the most-valued fintech in India, like any other digital credit distributor, operates on a heavily-cash burning business model with no clear paths to profitability and significant regulatory headwinds. In its IPO, with a listing price that was 16X its revenue, PayTM warned its investors to not expect the company to turn profits anytime soon.

But since market rewards growth prospects over actual profits, digital lending remains an investment hotspot. Simply because there is immense promise and potential. The traditional lending practices do not cut anymore with digitally-empowered customers who demand a near-instantaneous, seamless and enriching experience across touchpoints, every time. Digital lenders have cracked the speed and experience quotient with technology. But that’s how far technology would take them without a solid foundation of business understanding.

Approaches towards risk assessment and collections remain largely nascent for digital lenders. Their sophisticated artificial intelligence or machine learning algorithms are trained on rules and training sets that do not cover the nuances of the lending business. Instead, these models will have to be trained, tested, and continuously honed with in-depth domain expertise and regulatory compliance know-how to achieve business viability.

At the same time, the biggest flaws in the digital lending ecosystem currently relate to the 'promised digital land' where customer acquisition cost are lower and underwriting cheaper. None of those things are in play for most incumbents because of a lack of necessary infrastructure that guardrails them against losses. Lending is an inverted business model, giving money is easy and then you have to earn it back. Solving for only distribution without building a business proposition is missing the woods for the trees.

At FinBox we are helping digital lenders across the spectrum build resilient lending products through our digital credit infrastructure. Our risk engines are trained on India’s widest set of new to credit customers on thousands of unique parameters that streamline decisioning, monitoring as well as collections. Our infrastructure is designed with deep industry expertise and is aligned with business processes and workflows that help lenders, distributors as well as to-be-fintechs to create a sustainable business out of lending.

Let's make digital lending profitable together. Hit us up here.