Hi,

Credit is booming in India. Bank credit has been up by 17% (YoY), the MSME loan market grew to 36.4 trillion, and retail loans grew by 16% (YoY). Strong demand for housing and consumption loans appears to be aiding retail loan disbursal.

The unsecured side of credit is also on the rise. Buy Now Pay Later (BNPL) services, for instance, have been growing at 21% in the first six months of 2022, outperforming the 18% growth registered globally. If anything, this indicates stronger customer acceptance and more takers for credit.

Credit growth bodes well for the economy, but it also means heightened statutory responsibility for the Reserve Bank of India (RBI). An uptick in loan disbursals, especially of unsecured credit, warrants a thorough review of the business conduct and consumer protection practices, especially around digital lending.

To that end, the RBI introduced its Banking Ombudsman (BO) scheme as an expeditious and inexpensive forum for customers to resolve complaints.

Some major observations from the Annual report of the Ombudsman Scheme 2021-22 are -

The volume of complaints stood at 4,18,184 in 2021-22, an increase of 9.39% compared to the previous year.

Of the total complaints received in 2021-22, about 42 per cent were related to digital payments and transactions

Among the states/UTs that received the most complaints include Delhi, Chandigarh, Haryana, Gujarat and Maharashtra. The RBI posits that these trends could be attributed to higher awareness levels, better availability and higher usage of financial services, and physical and broadband connectivity when compared to other regions. The RBI satisfaction survey conducted in 2021 also revealed that avenues of redress tend to be higher in metro/urban areas

Complaints relating to ATM/debit cards have seen a decline over the past three years, however, the share of complaints related to mobile banking/electronic banking, credit cards and loans and advances has seen an increase

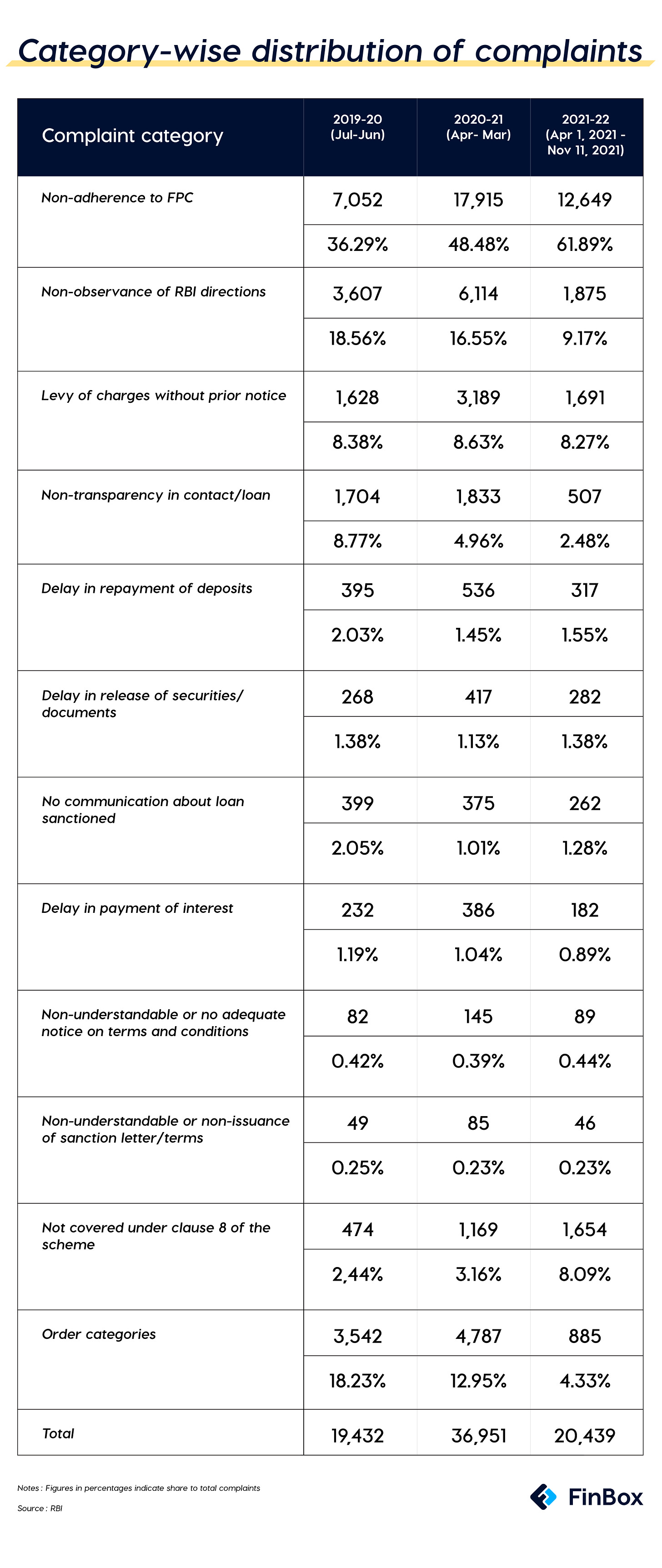

Loans and Advances contribute to the majority of complaints against NBFCs, followed by non-adherence to the Fair Practices Code

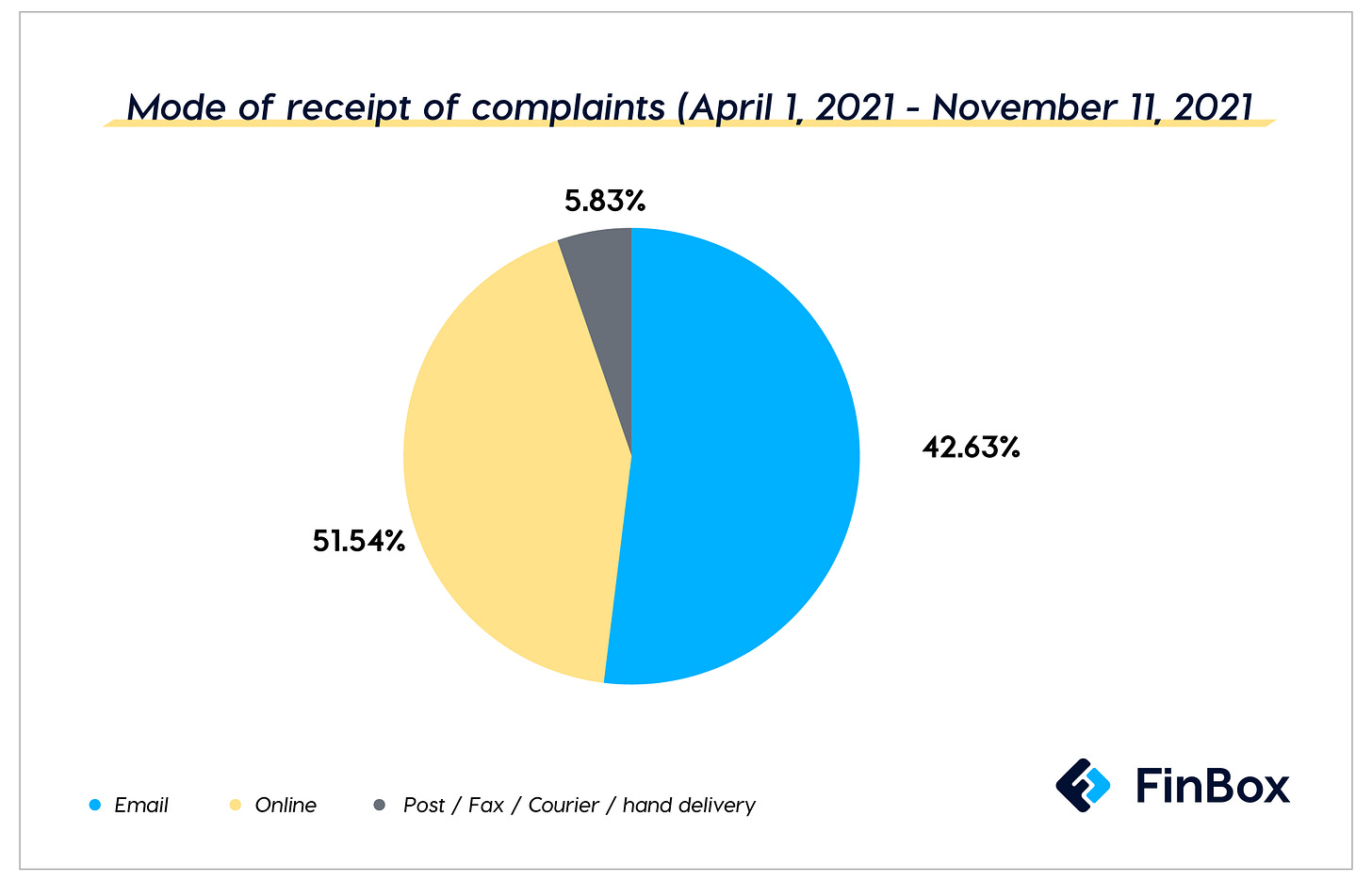

94.17% (19,248) of the complaints were lodged through digital mode using the CMS portal/ email/ CPGRAMS from April 1, 2021, to November 11, 2021.

The nature of complaints is largely related to non-adherence to the Fair Practices Code (FPC), non-observance of RBI directions, levy of charges without prior notice, and non-transparency in loans/contracts.

One of the observations that stood out in the Ombudsman report for me was the number of complaints that were registered digitally.

And to think about the nature of the complaints, along with the rising number of digital natives, makes me realise that innovation in digital lending is as challenging as it seems. And quite understandably also then, the RBI set up a Working Group on Digital Lending (WGDL) to provide recommendations on how to run a digital credit ecosystem with transparency, integrity and utmost security. And in a 2021 report released by the WGDL (an incredible report filled with a long list of suggestions and recommendations) the most poignant concerns were unbridled engagement of third parties, mis-selling, breach of data privacy, unfair business conduct, charging of exorbitant interest rates, and unethical recovery practices - very similar to the nature of complaints registered by the Banking Ombudsman in the last year.

If banks treat disputes simply as issues to be done away with, they can miss the silver lining: the opportunity to strengthen their relationship with customers. And here’s where a rather old, but often missed concept, comes into play - service design. And there’s a lot of scope for service design for financial services in the digital world.

Service design, put simply, is designing your products and services in a way that benefits your employees and customers and have them coming back for more. It's obviously about the User Interface (UI) of your website and app, but also about how much banks can modernise the middle (call centres, complaint management systems) and the back end (operations).

For starters, banking should be viewed as a service, not as a necessary evil. And trying to figure out how customer perception can be changed is a good enough starting point. I’ve tried to put together three broad points to begin to be more service-oriented.

1) Educate, inform, be transparent

The way I look at it, education is easier said than done, especially for banks looking to up their lending volumes by including new-to-credit (NTC) customers. It requires networks in grass-root organisations. We’ve written about how bank partnerships with Farmer-Producer-Organizations (FPOs) in rural areas are essential to agricultural lending. That’s one part of the service design, the other part is educating urban customers - making terms and conditions easy to read! 77% of the users never read the terms and conditions of most apps. Credit terms are harder to read and comprehend, so it makes sense to give the most important information upfront and in a digestible format.

To deal with the lack of transparency, the ‘levy of charges without prior notice’ for instance,

WGDL recommends

that banks should factor in all contingent costs and abide by the definition for the cost of digital Short Term Consumer Credit (STCC)/micro credit that the RBI may define. The transparency would help customers compare different loans more fairly, and help make decisions on availing or repayments with a better mental accounting of the costs.

“REs to provide a Key Fact Statement (KFS) to the borrower before the execution of the contract in standardised format for all digital lending products. Any fees, charge, etc., which is not mentioned in the KFS cannot be charged by the REs to the borrower at any stage during the term of the loan.” - going forward - will be mandated to be shared in an abridged format to customers via E-mail/SMS (along with the sanction letter), which will help borrowers in understanding how the loan operates.

2) Analytics-driven dispute resolution

Banking operations are driven largely by employees. They’re responsible for completing larger volumes of repetitive tasks on a daily basis - customer disputes related to credit/debit cards, internet banking, approving loans, and ensuring proper processing of payments. Obviously, these repetitive tasks can lead to an increased risk of errors.

Being analytics-driven means automation of these processes, which can also reduce human bias in decision-making and significantly reduce errors. More importantly, the plethora of data banks are sitting on can transform dispute resolution on a deeply granular level and be proactive rather than reactive.

Banks can identify errors, such as miscalculated fees or double payments, even before they are reported by the customer. This allows the bank to proactively alert the customer and inform them that the mistake has been corrected, which can significantly improve customer satisfaction.

Additionally, through predictive modelling, banks can anticipate potential issues and reach out to customers proactively. For example, if a bank notices that older customers tend to call within the first week of opening an account or receiving a new credit card, an AI customer service representative could reach out to check in and address any concerns.

3) Be a journey-based organisation

We’ve talked a bunch and written a bunch of digital journeys - make them user-friendly, auto-populate, easy-to-read, optimise for speed, personalise the experience etc. But how is hyper-personalisation implemented, really?

Currently, functions such as call centres, payments processing, and risk underwriting are structured by product or segment. However, as banks shift towards personalised interactions, a journey-based operating model will be necessary. This approach ensures that operations resources take responsibility for the customer inquiry or problem until it is resolved. A journey-based model integrates resources with different skills and knowledge and breaks down the existing silos. To implement this, banks will have to re-evaluate their staffing, performance measurement, and tracking processes to ultimately provide better customer service.

Loan recovery, for instance, has been muddled with multiple parties involved on behalf of the lender, to collect pending dues and is often suspected of unfair practices by unauthorised agents, who attempt to collect due by employing arm-twisting tactics. Banks need to think about how they make the collection process smooth. Either by employing smart, analytics-driven collections softwares like CollectX or if they have to employ LSPs for the process, the WGDL recommends “REs to communicate to the borrower, at the time of sanctioning of the loan and also at the time of passing on the recovery responsibilities to an LSP or change in the LSP responsible for recovery, the details of the LSP acting as recovery agent who is authorised to approach the borrower for recovery”

In terms of service design, banks could notify the borrower of the name, and designation of the person appointed for collections. Alternatively, it could also send nudges to the borrower to pay on time, to avoid any disputes.

This is not to say banking will ever be without disputes. The very nature of banking elicits the most intentional service, otherwise, the smallest missing link can have grave consequences for individuals, businesses, banks and the economy.

In conclusion..

To think about it, despite digitisation and an increase in the number of modern credit products such as BNPL and credit lines, one could assume that all is well with banking and financial services. However, bank systems are overwhelmed by complaints. And imaginably so, there is definitely more room for distress when your money is on the line. And for long, customer experience in the digital economy was viewed as elegant apps built for speed and ease; that ‘redefining’ what banking meant an overhaul of what your website and/or app looks like (don't get me wrong, it's very important). But, in a world where everything is a service, how can banking be the best of both worlds - magical products backed by impeccable service?

I’d love to hear your thoughts!