Are Private banks getting MSME lending right?

Hi,

90% of Indian startups fail within the first five years.

Founding a startup then is audacious. And by that logic, starting a small business is then irrational. And requires a level of confidence akin to Han Solo.

One way to look at it is, that level of confidence is critical to success in a crowded country like ours. But on a risk management level, it’s utterly insane.

But banks have taken that leap of faith -

According to the latest CIBIL report, MSME credit demand has increased 2X compared to the pre-pandemic levels and banks have more or less met that demand with a 43% YoY (for the last quarter of FY 22) increase in total disbursements to the sector.

This means two things -

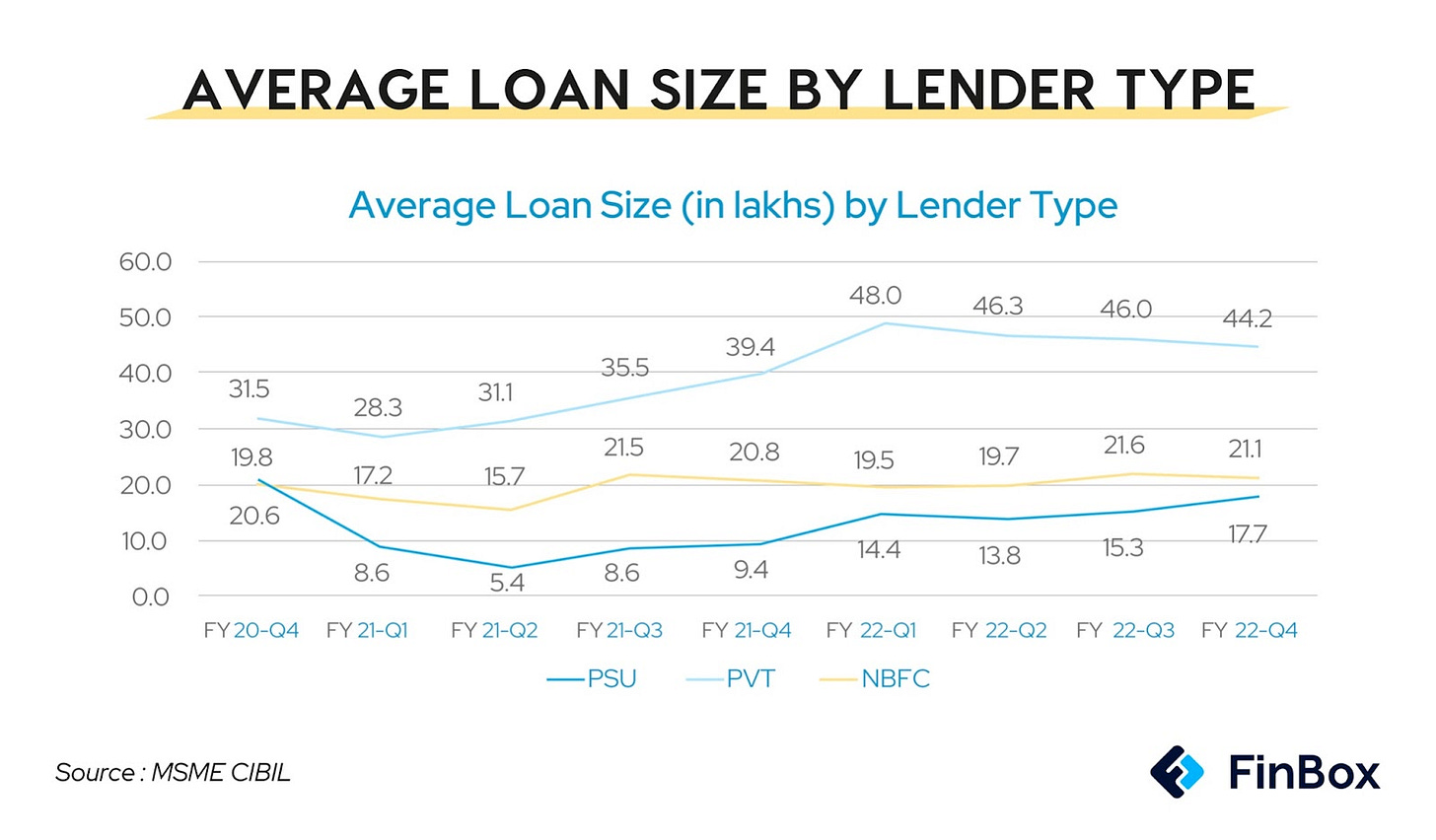

Lenders’ risk appetite has jumped and it shows in this graph below

The report suggests that the steady increase in average loan size is due to increased credit demand, lower interest rates, and most importantly - a higher risk appetite of private banks specifically.

NPAs are on the rise.

The non-performing assets (NPAs) in the micro, small and medium enterprise (MSME) sector have jumped 12.59% in the fourth quarter of the financial year 2021-22 to Rs 2.95 lakh crore from Rs 2.62 lakh crore during Q4 FY21

The NPA rate for PSBs, which has been highest in comparison to private banks and NBFCs, increased from 16.% in Q3 FY21 to 21.1 % in Q2 FY22 but remained stable at 20.8 % as of Q4 FY22. For NBFCs too, the NPA rate peaked from 8% in Q2 FY21 to 10.9% in Q1 FY22 before dropping to 9.6% in Q4 FY22.

My colleague Mayank wrote about why banks’ risk appetite increased, especially towards a segment once considered bank-unfriendly. You can read it here.

One of the interesting inferences we can draw from the report is that NBFCs are no longer the messiah for MSMEs. And that private banks are getting their risk strategies right. Private banks are doling out bigger loans and still managing to curb their NPAs better than PSUs and NBFCs.

It's safe to assume a few things here -

PSUs are giving out smaller loans and are weary of taking the risk on high-value loans. This can be policy-driven too due to Mudra and such schemes being pushed by the government. Small loans tend to be used for consumption purposes not geared towards productive gains.

The current bank-driven lending model is unable to cope with the size and speed of these needs and also runs afoul of most risk managers. My colleague Anna did a deep dive into Mudra loans and sums up the problem beautifully -

“Legacy systems aren’t exactly the most famous for underwriting new-to-credit customers with speed and accuracy, or even economically for that matter. A BusinessLine article pointed out how banks, NBFCs, RRBs and cooperative banks have simply opened another window for Mudra loans, bypassing the hard legwork expected of microfinance companies. At best they assessed the digital footprints of the SME sector left on the GST portal and jumped on the Mudra bandwagon. The bottom line is that many microcredit schemes have degenerated into conventional business loans riddled with NPAs.”

There are also a few narratives that have been turned on their heads

NBFCs, while the first to venture into MSME lending, are now laggards

Public sector banks, despite multiple schemes, and policies and despite being the star child of the RBI, are facing the higher NPAs

Private sector banks suddenly have greater credit exposure to MSMEs despite being historically reticent to lend to the sector

That’s all for my observations. Now for the questions -

Is it a moral hazard problem? Especially in agriculture, where the prospect of a farm-loan waiver gives an incentive to delay payments. This explains why the NPA ratio for PSBs is at 11.36% (for 2021) and 3.78% for private banks. There has been relentless pressure on PSBs to lend to agriculture, for instance; add to this lower level of due diligence when disbursing credit. The same does not hold true for private banks, which manage cleaner portfolios.

Is it an accessibility problem? Most SMEs are in smaller towns and rural areas and public sector banks have more connectivity in the interiors of the country than large private sector lenders. This could possibly mean that public sector banks are approached for smaller loans on a need-based consumption basis.

Government-sanctioned schemes like Mudra are low-value loans, can SMEs really build a business on the back of such schemes? The Pradhan Mantri Mudra Yojana (PMMY) was launched in 2015 with the objective of providing collateral-free loans for poverty alleviation. Under the Mudra scheme, Shishu loans (up to ₹50,000) are the most popular and also touted as the most important category by the government. However, the average value of these loans is a meagre ₹27,000. This piece on Mudra loans summarizes the problem -

“ An India Today article suggested a hypothetical scenario where each loan generates a 20% return. Despite taking a liberal account, Shishu loans can generate a maximum of ₹4,617 in a year for an average loan size of ₹22,516. Let’s add a layer to this. Assuming, the interest rate payable is a nominal 7.5%, a borrower will have to dish out ₹1,688 as interest. This means he is left with ₹2,929 i.e ₹244 a month. Well, it would be safe to assume that when onion prices peak, a Shishu loan borrower will be able to comfortably buy a kilogram with the income generated from the loan.”

Do private banks have a better distribution strategy? Private sector banks have adopted digitisation faster than public sector banks. This means partnerships with third-party loan origination companies, more partnerships with infrastructure-as-a-service and Omni/multi-channel presence. The underlying enabler for this is data and the technology to leverage it. Leveraging alternate data like accounts receivable from a Khata app, and data on past orders from a B2B E-Commerce app to better decide creditworthiness can make room for cleaner portfolios.

Are collection strategies still lagging behind technology? Sometimes debt collectors can overlook basic human behaviour - delinquency stems from the fact that borrowers forget their due date, face a temporary liquidity problem, or find repayment formalities overwhelming. And more often than not, delayed payment doesn’t mean an unwillingness to pay. A collections-specific portfolio monitoring model driven by machine learning, analytics, and prioritized segmentation would make for a multi-dimensional matrix that factors in a variety of dynamic parameters. The insights from this model enable lenders to determine their contact strategies — from deciding which communication channels to use to gauge the tonality and level of urgency to be deployed in the communication.

This nuanced approach has proven to create significant value. A McKinsey study states that it can reduce NPAs by 20-25%, increase resolution rate by 25%, cut down collection costs by 15%, and increase customer engagement by 5X.

The Bottom line

MSME lending is at an inflexion point. Financial institutions are finally recognising the profitability of lending to the sector. However, lending isn’t a business that usually responds well to fervour and fever. It needs to be well-thought-out, driven by partnerships with fintechs that have specialized in analyzing petabytes of data to deliver technology-driven credit product innovation and distribution strategies.

The ideal small business lender would then have -

The ability to deliver a streamlined digital experience. This would include a multi-channel, multilingual strategy that also includes basic training on technology for small business owners

Vertical specialization for a sector as heterogeneous as the MSME sector. And specializations rooted in industry expertise rather than geography.

I’ll leave you with a question - what does the future of small business lending look like?

I’d love to hear your thoughts.

Cheers,

Rajat